Accept The Chance To Shape Your Future Via Retired Life Preparation. Protect Your Gold Years And Unlock A State Of Economic Peace

Content Author-Bekker Kamp

When it comes to safeguarding your future, retired life preparation stands as a cornerstone for financial security and peace of mind. By taking aggressive steps today, you lay the groundwork for a comfortable and meeting retirement tomorrow. The decisions you make now can dramatically affect the high quality of your golden years, affecting whatever from your living circumstance to your pastime. As you browse the complexities of retirement preparation, recognizing its value is just the primary step towards a safe and secure and stress-free future.

The Benefits of Retirement Preparation

Planning for retirement provides a variety of benefits that can supply stability and peace of mind in your later years. By conserving and investing early, you're establishing yourself up for economic protection in the future. Having a retirement plan in position permits you to keep your existing way of life after you stop working. It gives you the flexibility to go after pastimes, travel, or just loosen up without worrying about cash. Furthermore, preparing for retired life aids you minimize dangers such as unanticipated medical expenses or economic slumps. Knowing you have an economic pillow can reduce tension and anxiousness, enabling you to appreciate your retirement to the fullest.

Furthermore, retirement preparation enables you to leave a legacy for your loved ones. By thoroughly handling your financial resources, you can ensure that your family is cared for in the future. Whether it's through inheritance or financial investments, you have the chance to offer your children or beneficiaries.

Trick Parts of a Strong Foundation

Developing a diversified investment portfolio is important for preparing of a solid retirement structure. By expanding your investments across different property classes such as stocks, bonds, realty, and products, you can decrease risk and enhance the potential for lasting development. This method assists secure your retired life savings against market changes and financial slumps.

Alongside a diversified portfolio, another essential component of a solid retirement foundation is establishing clear economic objectives. Establish just how much you need to save for retired life, thinking about aspects like your preferred way of life, healthcare expenditures, and inflation. Having particular targets in mind can lead your savings and financial investment choices, ensuring you stay on track to fulfill your retirement purposes.

In addition, frequently reviewing and adjusting your retirement plan is crucial for adjusting to transforming circumstances. Life occasions, market conditions, and personal goals might change gradually, demanding adjustments to your economic approach. By staying aggressive and adaptable, you can develop a resistant retirement foundation that supports your golden years.

Tips for Successful Retirement Preparation

To guarantee your retired life savings grow successfully, take into consideration these functional tips for effective retired life preparation.

Firstly, begin early. https://www.professionaladviser.com/news/4119848/women-financial-advice-awards-2023-shortlists-revealed begin saving for retirement, the even more time your cash needs to expand through compounding.

Next, set clear objectives. Figure out how much you'll require in retired life and produce a financial savings strategy to reach that target.

Additionally, expand your financial investments. Spread your money across different property classes to minimize threat and optimize returns.

Regularly testimonial and readjust your retirement plan as required. Life scenarios and monetary markets transform, so it's important to remain versatile.

Read the Full Posting from employer-sponsored retirement like 401( k) s and contribute sufficient to receive any kind of coordinating payments.

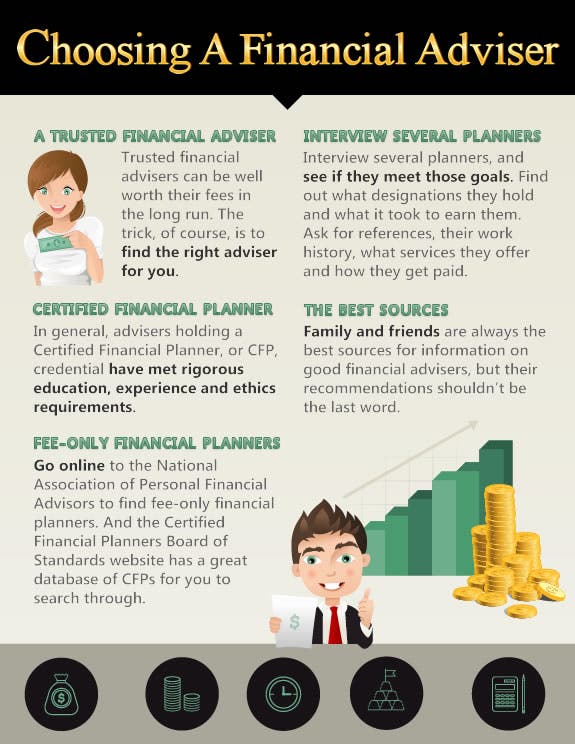

Finally, look for expert recommendations. A financial consultant can assist you produce an individualized retirement plan tailored to your goals and run the risk of resistance.

Final thought

To conclude, taking the time to prepare for your retired life currently will set you up for a protected and pleasurable future. By conserving, investing, and setting clear monetary objectives, you can construct a solid foundation for your golden years.

Remember to consistently review and change your retirement to ensure it stays resilient and adaptable to altering scenarios.

Start intending today to make sure a stress-free retirement tomorrow.